Analyze Various Funding Alternatives That Can Be Used to Support Debt Obligations

What is Debt Capacity?

Debt capacity refers to the total amount of debt a business can incur and repay according to the terms of a debt agreement . A business takes on debt for several reasons – such equally boosting production or marketing, expanding capacity, or acquiring new businesses. However, incurring also much debt or taking on the wrong blazon can result in dissentious consequences.

How do lenders make decisions on which businesses to lend their coin to? In this article, nosotros will explore the most usually used fiscal metrics to evaluate how much leverage a business tin can handle. At the terminate of the day, lenders wish to have comfort and confidence in lending their coin to businesses that can internally generate enough earnings and greenbacks menses to not only pay the involvement but also the chief residuum.

Source: CFI's free Introduction to Corporate Finance course .

Assessing Debt Capacity

The 2 main measures to assess a company's debt capacity are itsbalance sheet and cash flow measures. By analyzing key metrics from the balance sheet and cash flow statements , investment bankers determine the corporeality of sustainable debt a visitor can handle in an M&A transaction.

EBITDA and Debt Capacity

I measure to evaluate debt capacity is EBITDA, or Earnings Before Involvement, Tax, Depreciation, and Acquittal. To learn more about EBITDA, please meet our EBITDA Guide .

The level of EBITDA is important to assess the debt chapters, as companies with college levels of EBITDA can generate more earnings to repay their debt. Hence, the higher the EBITDA level, the higher the debt capacity. However, although the level of EBITDA is crucial, the stability of a company'southward EBITDA level is also important in assessing its debt capacity. There are a few factors that contribute to a company'due south EBITDA stability – cyclicality, applied science, and barriers to entry.

Cyclical businesses inherently have less debt capacity than non-cyclical businesses. For example, mining businesses are cyclical in nature due to their operations, whereas nutrient businesses are much more stable. From a lender'south point of view, volatile EBITDA represents volatile retained earnings and the ability to repay debt, hence a much higher default hazard.

Industries with low barriers to entry besides accept less debt capacity compared to industries with high barriers to entry. For example, tech companies that have low barriers to entry can hands be disrupted every bit contest enters. Even if tech companies are legally protected through patents and copyrights, competition will eventually enter as the patent term expires or with newer and more than efficient innovations. On the other hand, industries with high barriers to entry, such as long-term infrastructure projects, are less likely to exist disrupted past new entrants and, therefore, can sustain a more stable EBITDA.

Acquire more in CFI'south free introduction to corporate finance course .

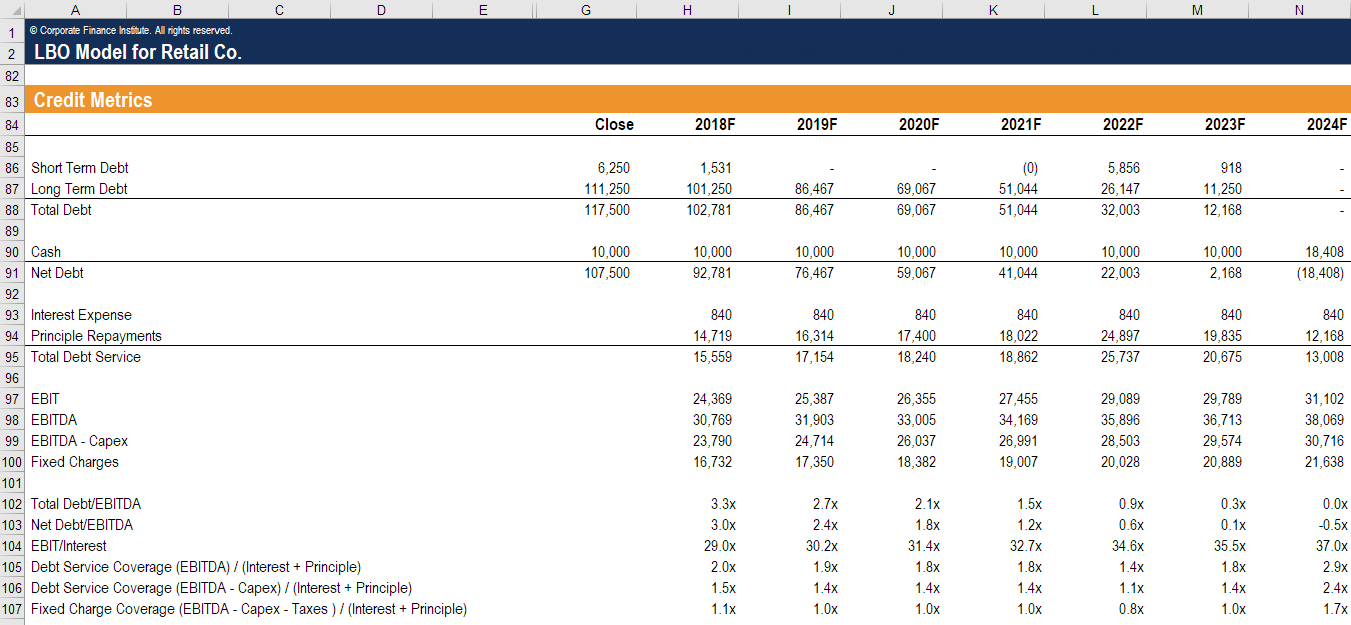

Credit Metrics

Credit metrics are extremely useful to make up one's mind debt capacity, every bit they direct reflect the book values of assets, liabilities, and shareholder equity. The well-nigh commonly used balance canvas measure is the debt-to-disinterestedness ratio. Other common metrics include debt/EBITDA, interest coverage, and stock-still-accuse coverage ratios.

As yous can see in the screenshot from CFI's financial modeling class below, an analyst volition expect at all of these credit metrics in assessing a company'south debt chapters.

Debt-to-Equity

Debt-to-equity ratios provide investment bankers with a loftier-level overview of a company's capital construction. However, this ratio can be complicated, as at that place can exist a discrepancy between the volume value and the market value of disinterestedness. Acquisitions, adjustments to assets, goodwill, and harm are all influential factors that may create a discrepancy between the book value and market value of debt-to-disinterestedness ratios.

Cash Menstruation Metrics

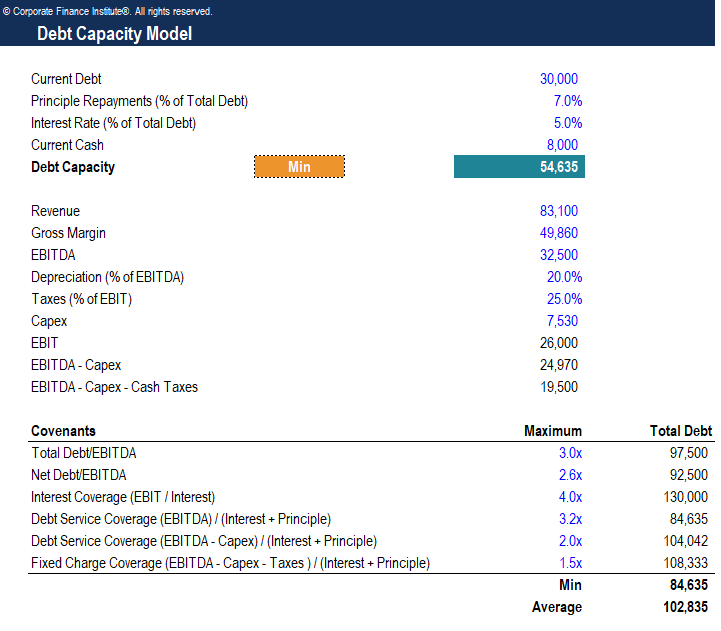

Another fix of measures investment bankers use to assess debt capacity is cash catamenia metrics. These metrics include total debt-to-EBITDA, which can be broken down further to senior debt-to-EBITDA, cash interest coverage, and EBITDA-Capital letter Expenditures interest coverage.

Full Debt / EBITDA

The Debt-to-EBITDA measure is the about common greenbacks flow metric to evaluate debt capacity. The ratio demonstrates a company's power to pay off its incurred debt and provides investment bankers with data on the corporeality of time required to clear all debt, ignoring interest, taxes, depreciation, and amortization. Total debt-to-EBITDA can be broken downward into the senior or subordinated debt-to-EBITDA metric, which focuses on debt that a company must repay kickoff in the event of distress.

Cash Interest Coverage

The cash interest coverage measure depicts how many times the greenbacks flow generated from business concern operations can service the interest expense on the debt. This is a key metric, as it shows not only a visitor's ability to pay interest but also its ability to repay principal.

Learn more in CFI's free introduction to corporate finance grade .

EBITDA-CapEx Interest Coverage

Past taking the EBITDA, deducting capital expenditures, and examining how many times this metric tin cover the interest expense, investment bankers tin can assess a company'south debt capacity. This metric is specifically useful for companies with loftier upper-case letter expenditures , including manufacturing and mining firms.

Fixed-Accuse Coverage Ratio

The stock-still-accuse coverage ratio is equal to a company'due south EBITDA – CapEx – Greenbacks Taxes – Distributions. The ratio is very close to a true cash flow measure and thus very relevant for assessing debt capacity.

Download the Free Template

Enter your name and e-mail in the form beneath and download the costless template now!

Additional Resource

Give thanks you for reviewing this article on debt capacity. CFI is a global provider of the Financial Modeling & Valuation Analyst (FMVA)® certification program and several other courses for finance professionals. To aid y'all accelerate your career, check out the additional CFI resources below:

- EBIT vs. EBITDA

- Revolving Debt Guide

- Market Value of Debt

- Debt Capital Markets

furphydianstand1949.blogspot.com

Source: https://corporatefinanceinstitute.com/resources/knowledge/finance/assessing-debt-capacity/